New York’s elite law firms are taking a page from their hometown baseball teams: Splashing cash to sign the industry’s most valuable players. While the strategy has had mixed success on the baseball diamond, law firm managing partners are hoping it will help them stay on top.

Davis Polk & Wardwell is the latest Wall Street firm to make competing for high-priced partners a much bigger part of its long-term strategy, joining others that have made adjustments to compensation models to match the huge salaries some partners now command in an active lateral market.

It’s a marked shift from decades of strategic complacency, when the “Wall Street firm” brand brought enough work and talent to New York’s premier firms that they largely minded their own shops, training next generation lawyers to take on long-term clients.

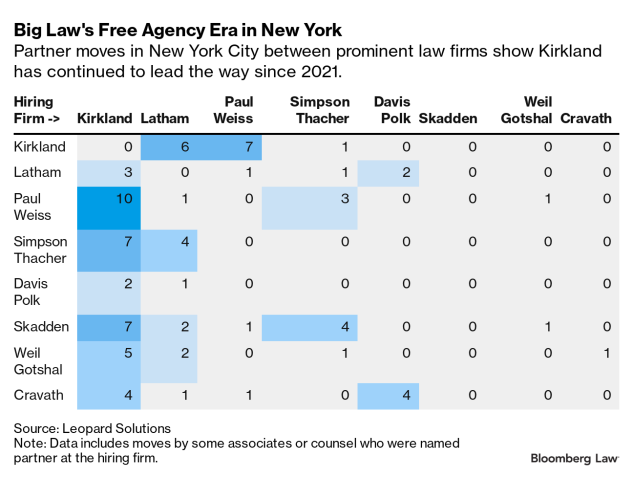

That moat has been shrinking for years as once-upstart competitors such as Kirkland & Ellis, Latham & Watkins, and others have lured partners from Manhattan’s white shoe firms, taking chunks of important markets like public company M&A and capital markets work.

Now, some Wall Street firms are finally ready to fight back, pulling more financial levers to match the highest salaries some partners command on the open market, which has ballooned to $20 million in recent years.

“They didn’t feel they needed to be the most entrepreneurial with clients or the most acquisitive of natural talent,” said David Walden, co-chief executive officer of legal search firm E.P. Dine. “But they got that wake-up call, and each firm has had to decide what they need to do to compete.”

Walden added: “The question now for the legal industry is: which of these top-tier, established firms adapt or die?”

Davis Polk is adjusting its compensation structure to make the higher end of its pay scale more competitive as it leans into the lateral market, managing partner Neil Barr said.

That move comes on the heels of even more drastic changes at Paul, Weiss, Wharton, Rifkind & Garrison, which has quickly become a major player in Big Law’s free agent era. The firm has adopted a two-tiered partnership and a black box compensation system, limiting how much partners know about their peers’ salaries.

The changes were designed “to address head-on the competitive realities of the current marketplace,” firm chair Brad Karp told The American Lawyer in March.

Cravath Swaine & Moore ended its strict seniority-based partner compensation approach in late 2021, and has more recently adopted a two-tiered partner structure.

Despite the changes, the firm has continued to suffer partner departures and has made just a handful of hires from rivals. Cravath early last year added former Weil Gotshal & Manges partner Peter Feist, who now co-leads the firm’s private equity practice.

To be sure, there is far from consensus among the Wall Street firms on what strategy is best to respond to today’s reality. Any break from tradition is not an easy endeavor for management. Hiring new partners and paying them more money than homegrown lawyers can risk a culture shock. Picking winners and losers among partners that were once similarly paid can unsettle the ranks.

“The landscape is changing,” said veteran legal recruiter Mark Jungers. “A lot of the firms that notably were at the top of the food chain 20 years ago, while they still may be there, they haven’t been evolving like Davis Polk or Paul Weiss.”

Jungers’ firm works with both Davis Polk and Paul Weiss.

Why Now?

Wall Street firms have lived under a poaching threat from rivals for a long time, even if they actively ignored it or downplayed its significance.

Industry observers cite multiple factors for why more firms seem willing to respond now.

For one thing compensation is spiking for Big Law partners at the most profitable firms. That’s made earning power a meaningful motivator for lawyers thinking about their futures. Partners are more frequently considering what that compounding effect will mean over a long career, and the numbers can be stark, as I wrote not long ago.

Also: As firms like Kirkland and Latham have grown into mature competitors in the New York market, moves to those firms are less risky than they once were. Kirkland now has the third-largest roster of lawyers in New York among the Top 50 firms, according to data from Leopard Solutions. The firm is behind only Paul Weiss and Davis Polk. Latham ranks sixth for New York lawyer headcount.

“You’re not taking risk to your career by joining some of the most stable, financially strong and healthy law firms in the world,” Walden said. “So for somebody who has dedicated their career to pursuing some of the most complex, sophisticated work for premium clients, that’s pretty exciting stuff.”

Another factor might be the underlying resilience of the law firm market. Firms’ financials were strong last year, after an up-and-down stretch in 2021 and 2022. Big Law has started this year hot, with revenue growing nearly 10% in the first quarter among the 100 largest firms, according to Wells Fargo’s Legal Specialty Group.

The 50 largest firms have the most pricing power. Their standard rates increased 9.8% in the first quarter, compared to 7.4% for the next 50 largest firms, Wells Fargo said.

It is easier to make investments in a strong market, and that is likely to be just one more reason why New York firms will make significant hires this year.

It may turn out to be a moment where law firm leaders look back and see that change happened slowly, then all at once.

“The story is still being written about the upper echelon of the law firm industry,” Walden said. “Agree or disagree with the magnitude of what’s occurring, it’s fascinating in part because of how quickly it’s happening.”